Views: 0 Author: Site Editor Publish Time: 2023-08-29 Origin: Site

In 2023, the photovoltaic price war will be launched in an all-round way

According to the statistics of the national power industry from January to March released by the National Energy Administration, By the end of March 2023, The cumulative installed capacity of photovoltaics is as high as 425.89GW, surpassing hydropower's 415.46GW,

Has jumped to become the second largest power supply in the country.

The news of cross-border and production expansion of listed companies continues, The photovoltaic market game continues to intensify,Product prices are low,Problems such as overcapacity coexist.

It has been analyzed that,2023 may become a watershed in the photovoltaic industry,the probability that the industry will face a new round of reshuffling,Photovoltaic price war has been fully launched.

A photovoltaic analyst in a certain place said,The photovoltaic industry is currently growing at a very fast pace,Price war is the inevitable result of rapid development.In the process of increasing demand for terminal installed capacity,The supply and demand structure of the upstream and downstream industrial chains is extremely unbalanced,Such as silicon materials, auxiliary materials, and cells, etc.,After some capital sees the investment opportunity of excess profit,Large-scale entry into the photovoltaic field to build factories and put them into production has caused a serious oversupply in the market.

Purchasing prices hit record lows

According to information from a certain place,Industrial silicon market confidence boosted poorly,Silicon prices are running low ;Polysilicon remained stable compared with last Friday,In the long run, the decline continues;Cell prices run smoothly,No significant change in inventory levels;Component prices are stable,High-purity quartz sand is still in short supply,The high price caused the market to pursue an upsurge,Prices are expected to continue to rise in the future.The price war in photovoltaics continues,The current market pressure is still great,The entire market is in a state of intense competition.

Price competition is an important means of competition among enterprises.In fact,indeed so,"The same scale, the lowest price wins",If an enterprise wants to win a large order in the centralized bidding,Usually, you can only choose to cut prices more significantly than other companies,So as to realize the price-for-quantity exchange.

Price competition can promote enterprises to optimize their cost structure to a certain extent.Upgrading technological innovation capabilities,The process of survival of the fittest will accelerate industry consolidation,Optimize the allocation of funds, resources and talents.

but,Vicious price competition will also cause retailers in the entire industry chain to lose money,In the absence of reasonable profit guarantees,In turn, it will inhibit the R&D investment of enterprises,Make the industry fall into a low-quality, level development process.

It should be mentioned that,The photovoltaic industry is not really like new energy vehicles,For example, Tesla leads the wave of price cuts,The supply chain of the photovoltaic industry is relatively scattered,Some verticals have an advantage in terms of cost,But there hasn't been a situation that has left other businesses with serious losses.

Liquor, home appliances and other giants cross-border

It is noteworthy that,since this year,Many listed companies and their major shareholders are vigorously deploying new energy industries,In particular, the enthusiasm for the photovoltaic industry has not diminished,The main businesses of these companies are distributed in various fields such as liquor, home appliances, jewelry, farming, and medicine,They are eager to seek new profit growth points,on the cusp of the times"Split a share".

Actually,cross border is nothing new,But for the news that Wuliangye, known as the "king of Chinese wine", has entered the new energy industry,It's still a bit surprising.

Enterprises enter the photovoltaic track,It just shows that the photovoltaic industry has a huge space for development,Everyone sees an opportunity to thrive.As long as there are breakthroughs and achievements in a certain field,can occupy a place in the market.It is never too late for enterprises to enter the photovoltaic industry,Whether it is across borders,Or extend the industrial chain,are very suitable for powerful enterprises,Only with a certain technical reserve,In order to be able to go longer in the photovoltaic industry.

Where are the opportunities in the photovoltaic industry chain?

Under such a circumstance,2023,Is there still play in the development of photovoltaic industry? Will the photovoltaic leader change hands? Where are the opportunities in the PV industry chain? These issues are worthy of our discussion.

According to an expert and industry insider, He is very optimistic about the development prospects of the photovoltaic industry,From a long-term market perspective, The direction of clean energy and green energy in the future is the general trend, Whether it is the photovoltaic industry or the wind energy ,All have very good room for development.

He argued that, The photovoltaic industry chain may undergo relatively large reshuffles and changes in the future, The market doesn't say that any one company can stay in the leading position for a long time and be a dominant player.

The photovoltaic industry is a technology-intensive industry, The existing leading enterprises have long-term industry and experience accumulation, Meanwhile, with the help of capital, The position is very secure, Its market position is relatively difficult to shake. but, If breakthroughs are made in management and operational efficiency as well as model innovation and upgrading, It may also become an opportunity for a few companies to emerge suddenly.

The market share of leading enterprises is relatively high, There will be no change of owner in a short time, In the long run, Some new technologies have advanced by leaps and bounds, However, it is still difficult to apply it on a large scale in the short term. so,The status of photovoltaic leading enterprises is still quite stable.

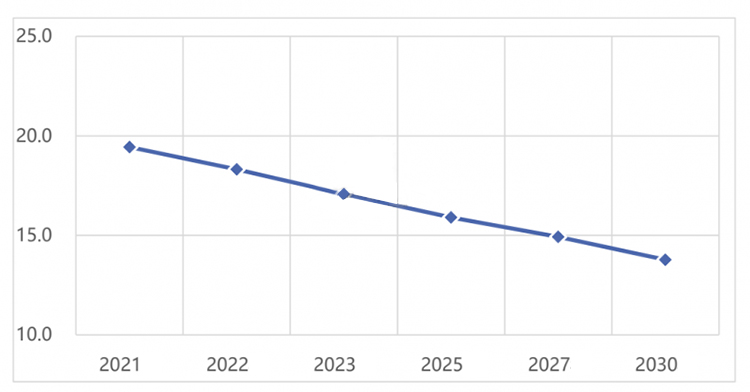

For photovoltaic price trends, The photovoltaic industry has always been developing around cost reduction and efficiency increase, The technology in each link is constantly iterating and improving, Production capacity is also expanding rapidly.

The continuous decline in the prices of main and auxiliary materials for photovoltaics is the general trend, Especially the upstream silicon material link, After the supply-demand imbalance improves, will also slowly and gradually return to a reasonable level of profitability, In the links of silicon wafers, cells, and components, It will also decline with the change of its upstream price, So as to benefit the terminal, After the cost of electricity per unit of the terminal decreases, The demand for photovoltaics will further increase.

In terms of industrial chain opportunities, An opportunity with a relatively large industrial chain. The first is the quartz crucible, At present, the photovoltaic industry lacks quartz crucibles, High-quality silicon wafers and batteries must use this raw material, If this problem can be solved, The industrial chain may develop in a more balanced manner.

The second is that there is a shortage of supply chains for accessories such as heterojunctions and low-temperature gels. As far as the photovoltaic industry chain is concerned, According to the overall market demand, Gradually reach a more balanced state.

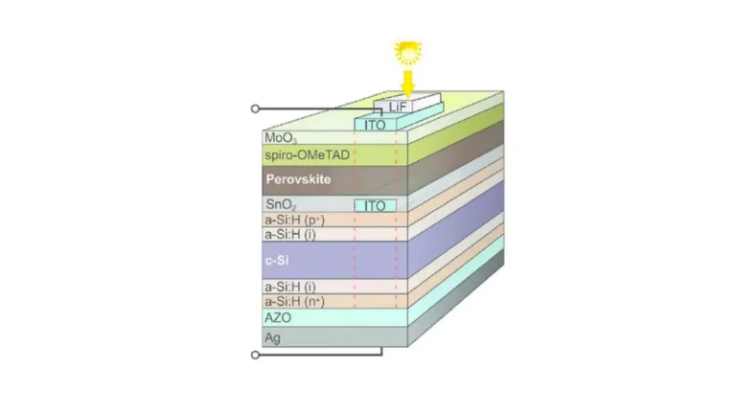

Emerging opportunities in the photovoltaic industry will revolve around new technologies, new R&D investments,Including N-type battery TOP Con, heterojunction, perovskite, etc., In the future, the cell link may be the most important link in the photovoltaic industry chain, Because with the release of silicon production capacity, Upstream silicon materials are no longer scarce, There is no longer a structural price increase, When the silicon material link does not have these characteristics, The cell link will become a must for everyone, Thus in the field of cells and cell equipment the,If there is progress in research and development, as well as being able to bring about improvement of the conversion efficiency.

The opportunities brought by the battery segment are still quite large, Very optimistic about the future prospects of cell related equipment manufacturers.

content is empty!

content is empty!